Fake Customers: Synthetic Accounts in Your Database are Profit Parasites

Synthetic customers are there, even if you don’t see them

Synthetic customers are there, even if you don’t see them

There’s no denying that customer data platforms (CDPs) are a must-have tool for today’s companies. Consolidating customer data into one location is much more manageable. Aside from data privacy considerations—particularly in finance and healthcare—a CDP’s organized, streamlined view of customer data activates personalized user experiences and offers for existing customers while accurately identifying prospective customers who are most likely to drive revenue.

But synthetic fraud, which now accounts for 85% of all identity fraud, is infesting the tidiest and most closely monitored of CDPs. Most CDPs scan for telltale signs of fraud in real-time; however, synthetic fraudsters are too smart for that. The ubiquity of AI, and its ever-growing intelligence, enables bad actors to create and manipulate synthetic identities that appear more human than ever. The signs of fraud aren’t so obvious anymore, and the cybersecurity tools used by many companies aren’t up to snuff.

Effectively stomping out synthetic identity fraud requires an obsessive degree of CDP hygiene. This, of course, isn’t possible without a thorough understanding of what synthetic identities are capable of, how they operate, and the strategy companies must adopt to neutralize them.

Silent killers

No intelligence agency wants to readily admit it’s been infiltrated by a spy, and no CEO is exactly chomping at the bit to admit their company’s customer database is crawling with fake customers. When PayPal’s then-CEO, Dan Schulman, admitted to over 4 million fake customers it cost the fintech company over 25% in market capitalization. But these fraudsters are indeed there, camped out in CDPs and operating like legitimate customers—deposits, withdrawals, credit services, the whole nine.

A recent Wakefield report surveyed 500 senior fraud and risk professionals from the US. More than 75% of these executives said they had synthetic customers. Half of respondents deemed their company’s synthetic fraud prevention efforts somewhat effective, at best.

Perhaps most troubling? 87% of these companies admitted to extending credit to synthetic customers, and 53% of the time credit was extended proactively, via a marketing campaign, to the fraudster. These fraudsters aren’t just incredibly human-like and patient—they’re in it for the big haul. And according to the FTC’s 2022 report on identify fraud, the per-incident financial impact is in excess of $15K.

Synthetic Sleeper identities, as we call them, can remain in CDPs for months, in some cases over a year. They deposit small amounts of money here and there while interacting with the website or mobile app like a real customer would. Once their credit worthiness gets a bump, and they qualify for a loan or line of credit, pay day is imminent. The fraudster performs a “bust-out,” or “hit-and-run.” The money is spent, and the bank is left with uncollectible debt.

This is not your grandmother’s synthetic identity. Such intelligence and cunning is the handiwork of synthetic fraud’s latest iteration: the SuperSynthetic™ identity.

SuperSynthetic, super slippery

How are synthetic fraudsters turning CDPs into their own personal clubhouses? Look no further than SuperSynthetic identities. The malevolent offspring of the ongoing generative AI explosion, SuperSynthetics are growing exponentially. In Deduce’s most recent Index, 828,095 SuperSynthetic identities are being tracked in the identity graph. These are hitting companies, especially banks, with costly smash-and-grabs at an unprecedented rate.

SuperSynthetics aren’t high on style points, but why opt for a brute force approach if you don’t need to? These methodical fraudsters are more than content playing the long game. Covering all of their bases allows for such patience—their credit history is legit; their identity is realistically aged and geo-located; and, for good measure, they can deepfake their way past selfie, video, or document verification.

Even the sharpest of real-time fraud detection solutions are unlikely to catch a SuperSynthetic. The usual hallmarks—an IP address or credit card being used for multiple accounts, behavioral changes over time—aren’t present. A SuperSynthetic is far too pedestrian to raise eyebrows, depositing meager dollar amounts over several months, regularly checking its account balance, paying bills and otherwise transacting innocuously until, finally, its reputation earns a credit card or loan offer.

Once the loan is transferred, or the credit card is acquired, it’s sayonara. The identity cashes out and moves on to the next bank. After all, the fraudster does not care about their credit score for that identity, one of dozens or hundreds they are manipulating. It has done its job and will be sacrificed for a highly profitable return.

Fake identities, real problems

Deduce estimates that 3-5% of financial services and fintech new accounts onboarded within the past two years are SuperSynthetic identities. Failing to detect these sleeper identities in a CDP hurts companies in a multitude of ways, all of which tie back to the bottom line.

Per the Wakefield report, 20% of senior US fraud and risk execs say synthetic fraud incidents rack up between $50K-$100K per incident. 23% put the number at $100K+. The low end of this range sitting at a whopping $50K should be alarming enough to reconsider preemptive counter measures against CDP breaches.

Another downside of synthetic infiltration is algorithm poisoning. Since the data for synthetic “customers” is inherently fake, this skews the models that drive credit decisioning. Risky applicants can be mistakenly offered loans, or vice versa. For banks, financial losses from algorithm poisoning are two-fold: erroneously extending credit to fake or unworthy customers; and bungling opportunities to extend credit to the right customers.

A signature approach

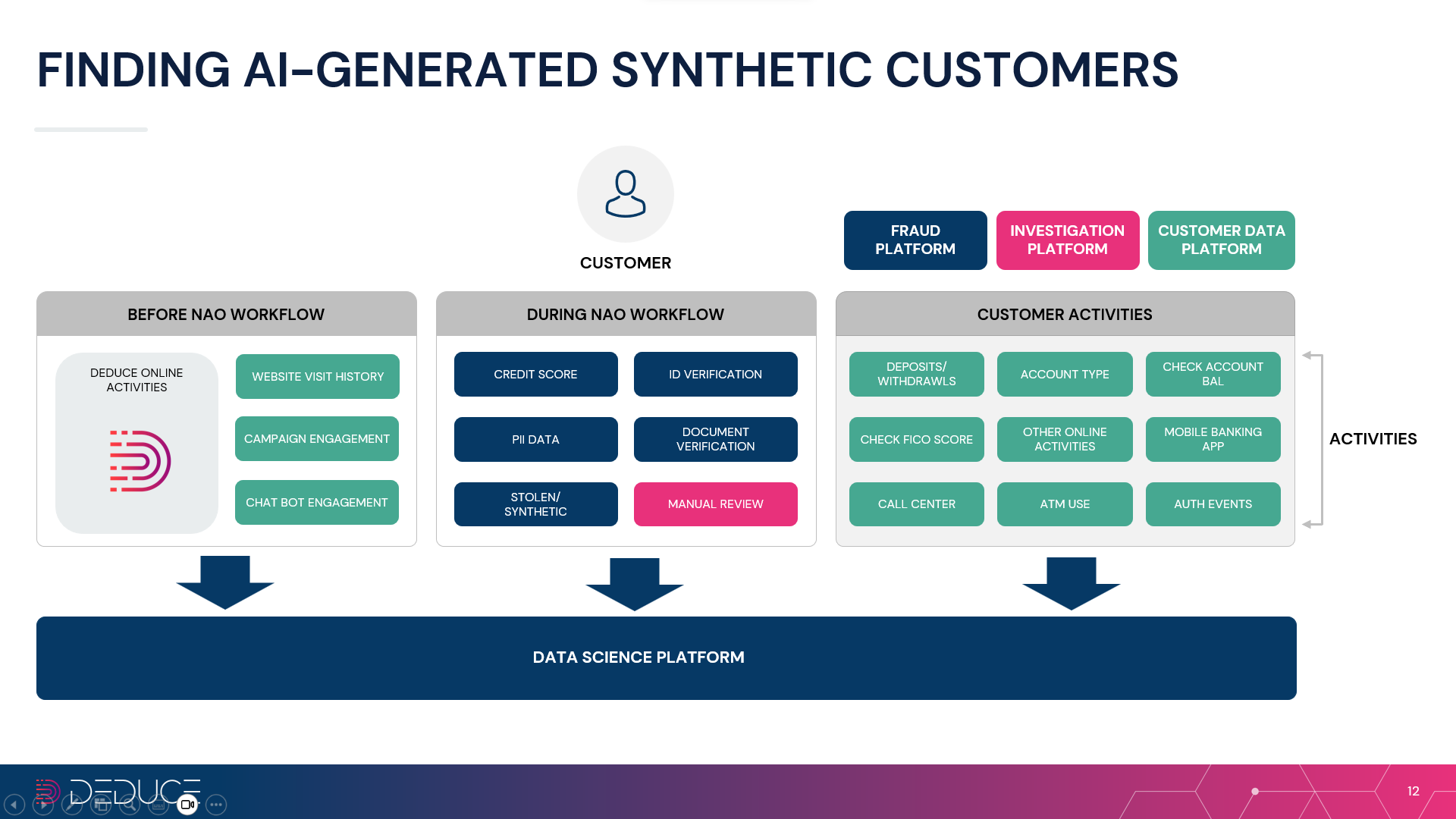

The good news for financial services organizations (and their CDPs) is the battle against synthetic, and even SuperSynthetic, identities is not a futile one. The same strategy that’s effective in singling out synthetic identities pre-NAO (New Account Opening) can help spot synthetics that have already breached CDPs.

Even if a SuperSynthetic has already bypassed fraud detection at the account opening stage, gathering identity activity from before, during, and after the NAO workflow and analyzing identities collectively, rather than one-by-one, unearths SuperSynthetic behavioral patterns.

Traditional fraud prevention tools take an individualistic approach, doubling down on static data such as device, email, IP address, for singular identities. But catching synthetic fraudsters, pre- or post-NAO, calls for tracking dynamic activity data over time. At a high level (literally), this translates to a top-down, or “birdseye,” strategy—powered by an enormous and scalable source of real-time, multicontextual identity intelligence—that verifies identities as a group or signature. Any other plan of attack is doubtful to pick up the synthetic scent.

Per the slide above, a unique activity-backed data set augments the data from a CDP and fraud platform to ferret out synthetic accounts. To catch these slithery fraudsters more data can and should be deployed. Knowing how an identity behaved online prior to becoming a customer bolsters the data science models used to give CDPs a synthetic spring cleaning.

What does this look like in practice? Say a real-time scan of in-app customer activity reveals, over an extended period, that multiple identities check their account balance every Thursday at exactly 8:17 a.m. Patterns such as this rule out coincidence and uncover the otherwise clandestine footprints of SuperSynthetic identities.

The intelligence and elusiveness of SuperSynthetics are increasing at a breakneck pace. In addition to terrorizing CDPs, SuperSynthetics have the potential to peddle sports betting accounts, carry out financial aid scams, and even swing the stock market via disinformation campaigns. Given what’s at stake, not combating SuperSynthetics with a thorough activity-driven approach, for some companies, might spell serious trouble in the year ahead.