Deduce Multicontextual Identity Insights

Stop Stolen and Synthetic Identity Fraud

Restore Trust in the Fight Against AI-Driven Identity Fraud

Even before AI, stolen and synthetic identity fraud were the fastest growing segments of identity fraud, causing billions in losses each year.

Now fraudsters have the GenAI tools to scale up their blending of stolen and fake data, and to generate entirely fictional documents, biometrics, online activities, credit histories, and other human-like attributes.

These identities can pass legacy automated fraud controls, IDV assessments, manual reviews, KYC checks, 2FA, and other identity verification processes. Once they’re approved, they become fraud “sleepers” in customer databases until they’re offered credit based on their realistic looking activity history.

With more stolen and synthetic identities bypassing legacy controls, trust in “verified” identities across systems is eroding. And as institutions try to tighten up their onboarding processes using legacy tools, false declines are spiking and customer acquisition KPIs are taking a hit.

Stolen and synthetic identities destroy trust by bypassing legacy controls

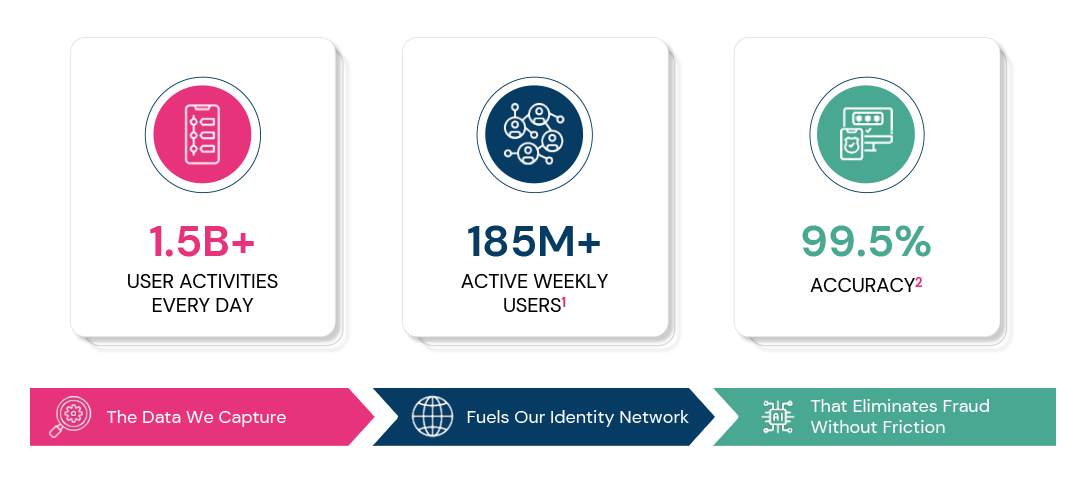

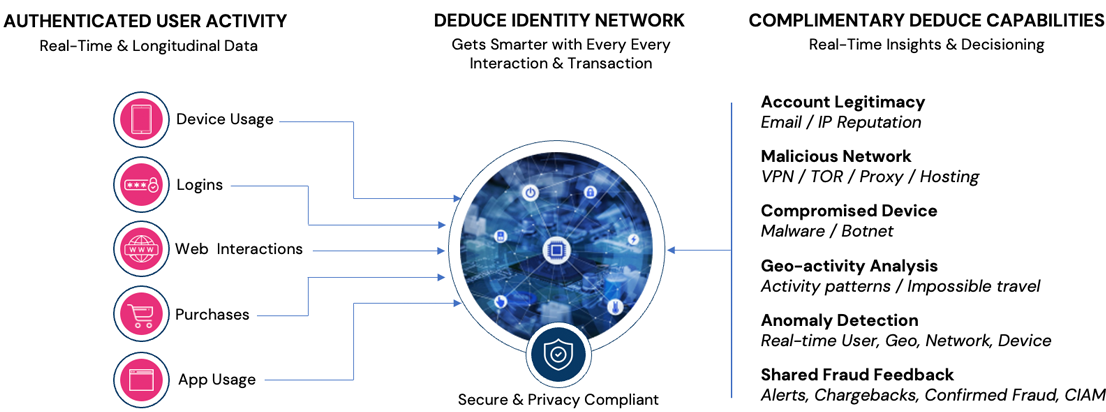

Activity-Backed Insights

Powered by the Deduce Identity Graph

Authentic, Stolen, or Synthetic? Deduce Flags AI-Driven Identities That Legacy Tools Can’t Detect

Deduce spent five years developing AI-driven identity fraud detection tools in anticipation of AI’s growing ability to create highly realistic fake identities.

Keeping these identities from becoming your “customers” reduces your exposure to loan, credit card, BNPL, and other forms of financial fraud, and helps you maintain trust in the authenticity of your approved customers.

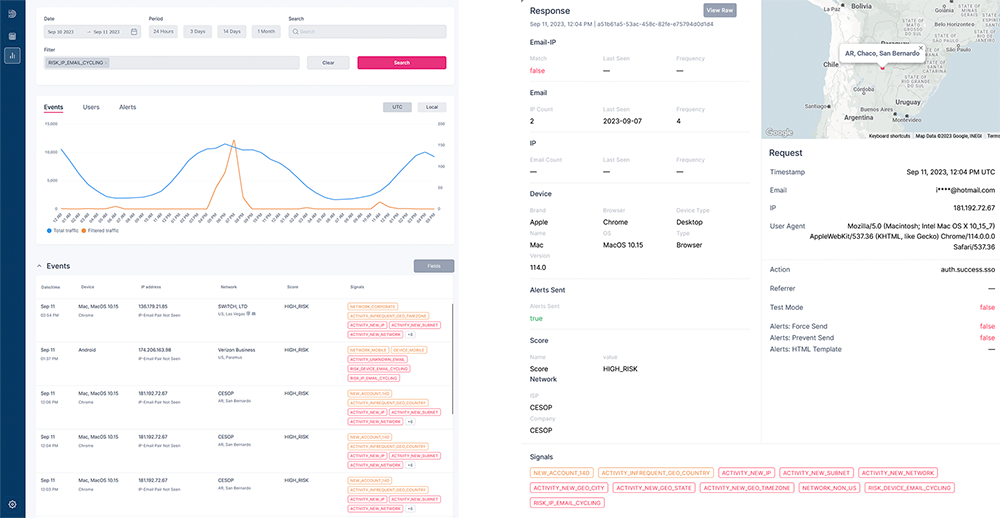

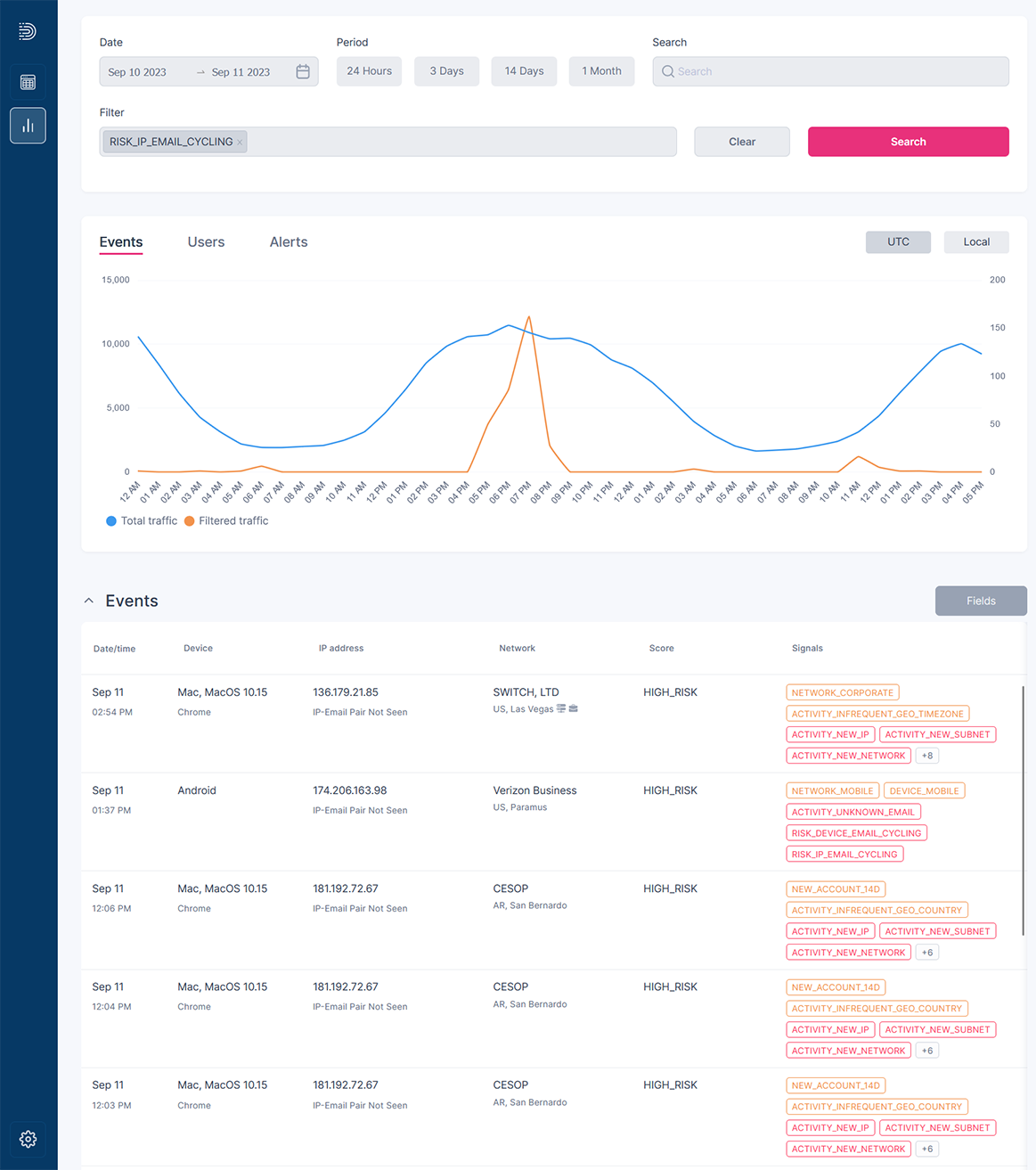

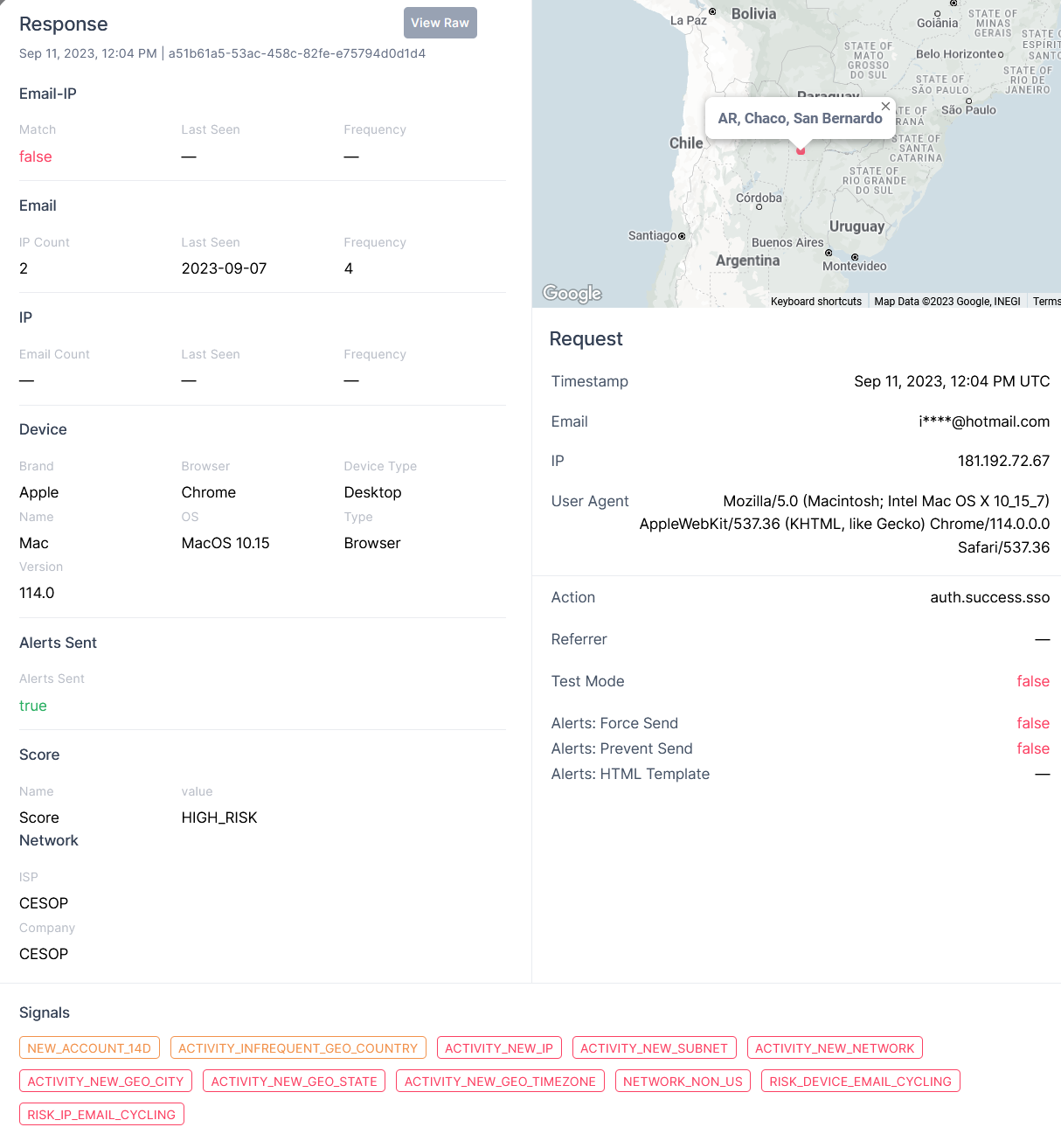

Deduce can identify AI-driven new identities in a fraction of a second from one lightning-fast API query—no JavaScript required, no excess NAO costs, and a reduction in false positives.

Deduce for New Account Fraud Prevention

Employ our Identity Graph and patented technology at the top of your account opening waterfall as a layer of defense against stolen and synthetic identity protection available nowhere else, so you can:

- Restore trust in your organization’s customer authentication processes.

- Reduce false declines and account-creation churn, with faster time to approval for trusted users.

- Prevent exposure to AI-generated identity fraud risks, which can take months or years to manifest.

- Save money on secondary IDV calls and manual reviews related to stolen and synthetic account applications.

- Augment your fraud stack for more comprehensive identity fraud protection.