Is Your First-Party Synthetic Fraud Skyrocketing? Here’s Why

That rise in first-party synthetic fraud is no fluke. You have a SuperSynthetic identity problem.

That rise in first-party synthetic fraud is no fluke. You have a SuperSynthetic identity problem.

Online fraud in the US totaled a record-breaking $3.56 billion through the first half of last year. Most consumer-facing companies have done the sensible thing and spent six or seven figures fortifying their perimeter defenses against third-party fraud.

But another effective, and seemingly counterintuitive, strategy for stopping today’s fraudsters is to think inside-out, not just outside-in. In other words, first-party synthetic fraud—or fraud perpetrated by existing “customers”—is threatening bottom lines in its own right, by way of AI–generated synthetic “sleeper” identities that play nice for months before executing a surprise attack.

Banks and other finserv (financial services) companies shouldn’t be surprised if their first-party synthetic fraud is off the charts. Deduce estimates that between 3-5% of new customers acquired in the past year are actually synthetic identities, specifically SuperSyntheticTM identities, created using generative AI.

The good news is that a simple change in philosophy will go a long way in neutralizing synthetic first-party fraudsters before they’re offered a loan or credit card.

First-party problems

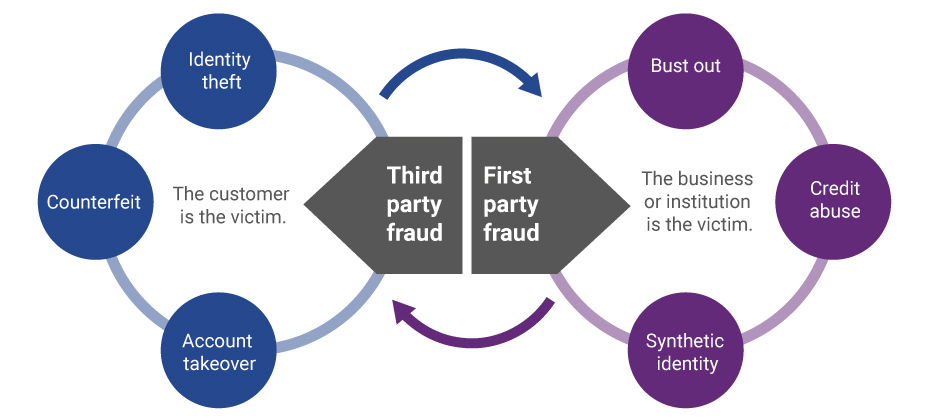

Third-party fraud is when bad actors pose as someone else. It’s your classic case of identity theft. They leverage stolen credit card info and/or other credentials, or combine real and fake PII (Personal Identifiable Information) to create a synthesized identity, for financial or material gain. Consequently, the victims whose identities were stolen notice fraudulent transactions on their bank statements, or debt collectors track them down, and it’s apparent they’ve been had.

First-party synthetic fraud is even more cunning—and arguably more frustrating—because the account information and activity appear genuine, complicating the fraud detection process. The aftermath is where it hurts the most. Since, unlike third-party fraud, there isn’t an identifiable victim, finservs have no one to collect the debt from and are forced to bite the bullet.

One hallmark of first-party synthetic fraud is its patience. These sleeper identities appear legitimate for months, sometimes more than a year, making small deposits every now and then while interacting with the website or app like a real customer. Once they bump up their credit worthiness score and qualify for a loan or line of credit, it’s game over. The fraudster executes a “bust-out,” or “hit-and-run,” spending the money and leaving the bank with uncollectible debt.

This isn’t the work of your average synthetic identity. Such a degree of calculation and human-like sophistication can only be attributed to SuperSynthetic identities.

That escalated quickly

An Equifax report found that nearly two million consumer credit accounts, over the span of a year, were potentially synthetic identities. More than 30% of these accounts represented a major delinquency risk with cases averaging $8K-10K in losses.

The blame for rising first-party synthetic fraud—and the finservs left in its wake—can be placed squarely on the shoulders of SuperSynthetic identities. These AI-generated bots are proliferating worldwide, scaling their sleeper networks to execute bust-outs on a grand scale.

SuperSynthetics—featuring a three-pronged attack of synthetic identity fraud, legitimate credit history, and deepfake technology—need not brute-force their way into a bank’s pockets. Aside from a SuperSynthetic’s patient approach and aged, geo-located identity, its deepfake capability, a benefit of the recent generative AI explosion, is key to securing the long-awaited loan or credit card.

Selfie verification? A video interview? No problem. Deepfake tools, some of them free, are advanced enough to trick finservs even if they have liveness detection in their stack. Document verification? There’s a deepfake for that, too.

SuperSynthetics don’t have a kryptonite, per se. But analyzing identities from a different angle boosts the chances of a finserv spotting SuperSynthetics before they can circumvent the loan or credit verification stage.

Dusting for fingerprints

If finservs want to sniff out SuperSynthetic identities and successfully combat first-party synthetic fraud, they can’t be afraid of heights.

A top-down, bird’s-eye view is the best way to uncover the digital fingerprints or signatures of SuperSynthetics. Individualistic fraud prevention tools overlook these behavioral patterns, but a macro approach, which studies identities collectively, illuminates forensic evidence like a black light.

Grouping identities into a single signature—and examining them alongside millions of fraudulent identities—reveals indisputable evidence of SuperSynthetic activities such as social media posts and account actions that consistently happen at the exact day and time each week by a group or signature of identities. Coincidence is out of the question.

Of course, not every finserv has the firepower to adopt this strategy. In order to enable a big-picture view, companies’ anti-fraud stacks need a large and scalable source of real-time, multicontextual, activity-backed identity intelligence.

There are other avenues. Consider, for example, the only 100-percent foolproof solution to first-party synthetic fraud: in-person identity verification. Even if this approach was used exclusively at the pre-loan juncture it seems unlikely that many companies would take on the added friction, though driving down to the bank is a small price to pay for a five or ten thousand-dollar loan.

If finservs don’t wish to revisit the good old days of face-to-face verification, the top-down, signature approach is the only other viable deterrent to first-party synthetic fraud. Solutions that analyze identities one by one won’t stop SuperSynthetics before a loan or credit card is granted, and by that point it’s already over.