Thwart Digital Goods Fraud with Real-Time Data

In the war against digital goods fraud, real-time is the only time

In the war against digital goods fraud, real-time is the only time

Today’s customer wants it, and they want it now. But, until teleportation becomes a reality, purchasing physical products online won’t satisfy their need for instant gratification. This is a big reason why digital goods purchases jumped 51% from 2020 to 2021, and, at last check, 65% in 2022.

The instant delivery of digital goods—software, event tickets, and especially online gift cards—spells trouble for e-commerce companies. Whereas physical merchandise often provides a multi-day delivery buffer allowing ample time for fraud detection and investigation, digital download products require an immediate decision on fraud. This overburdens the majority of fraud stacks and gives fraudsters the upper hand.

How can e-commerce merchants effectively combat digital goods fraud at scale—and steer clear of false positives—when these purchases demand a snap judgment?

The digital goods dilemma

Analysts anticipate that e-commerce merchants will lose about $24 billion to online payments fraud by 2024. Along with other types of e-commerce fraud, such as friendly fraud, new account fraud, and account takeover (ATO), digital goods fraud will wreak havoc in its own right.

Unlike purchasing physical products online, the instantaneous nature of buying digital products presents unique challenges:

Immediate delivery. With digital goods arriving to customers in mere seconds, e-commerce companies with traditional fraud stacks can’t review orders, successfully sniff out fraudulent transactions, or initiate manual reviews. It’s real-time or nothing, approve or reject.

False positives. Split-second approval times depend on strict guidelines to determine if digital goods customers are legit. Because fraud is so prevalent, e-tailers have tightened up security protocols more than ever and given rise to false positives. Wrongly identifying customers is the fast track to churn and lost revenue.

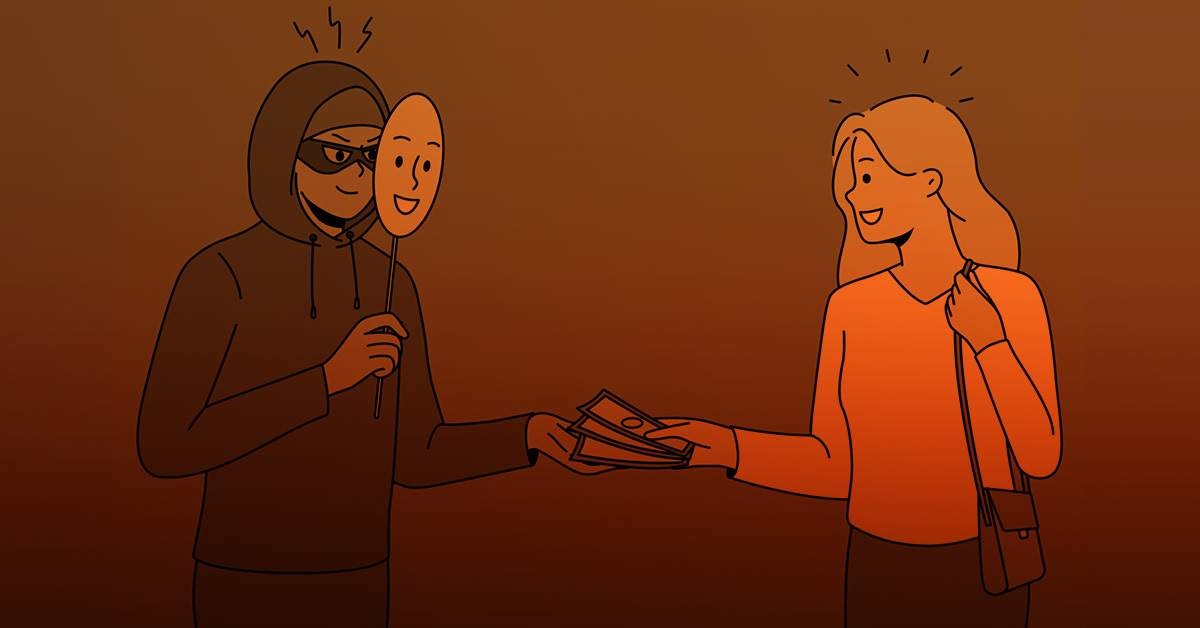

Lack of data. For merchants with an outdated fraud stack, or one that is based solely on transaction records or static data, digital goods purchases don’t provide nearly enough real-time data to accurately verify a transaction. No phone number, no physical address, no transaction history. Seasoned bad actors can easily deploy their arsenal of stolen or fake emails, combined with stolen credit card numbers, and mask their identities via proxy servers.

Whether a company is selling physical or digital products online, today’s lofty user experience (UX) expectations remain intact. Many customers are too impatient for passwords and confirmation emails and one-time passcodes (OTP). UX potholes typically lead to reputational blemishes and churn. E-gift cards, one of the more popular digital purchases, can cause similar damage if fraudsters get a hold of them.

E-gift cards leading the pack

E-gift cards, arguably, are public enemy number one in the war against digital goods fraud. In-store gift cards and e-gift card sales are expected to exceed $238 million by 2025. Given our increasingly online world and the growing consumer need for instant gratification, e-gift cards will likely comprise most of these sales. And, just as likely, a significant portion of e-gift card “customers” will be fraudsters.

Fraudsters purchase online gift cards using stolen payment info. More often than not their intention is to either resell the gift card for profit, or use it to launder money by using a stolen credit card to buy a legitimate debit card or merchandise gift card. E-gift cards are a win-win-win for bad actors: they are easy to obtain, easy to redeem, and practically untraceable since they require little to no personal data at checkout (usually just payment details and an email). Armed with their new legitimate digital card, a fraudster can enter a store and purchase a high-ticket product such as a flat screen TV or computer with no chance that the transaction will fail at checkout.

All digital goods fraud is bad news for e-tailers, but the effects of e-gift card fraud are particularly devastating. Chargebacks, customer experience issues, lost inventory. If consumers buy online gift cards from fraudsters and redeem them, companies, in most cases, will have to eat the cost of these transactions.

And don’t forget about the reputational impact. Similar to the fallout from false positives, victims of online gift card fraud, none too pleased with the merchant, will probably take their future business elsewhere.

Fraud detection in a flash

Unfortunately for online merchants, fraud risk, and the demand for digital goods and instant gratification, have reached an all-time high.

Fortunately for online merchants, the real-time data needed to thwart digital goods fraud, and approve genuine customers, is not the stuff of make-believe.

Deduce equips e-commerce vendors with the breadth of real-time, multi-dimensional identity intelligence and speed to approve or deny digital goods transactions at scale. When e-tailers layer Deduce on top of their existing fraud stack, they’re tapping into a network of 660 million US privacy-compliant identity profiles and 1.5 billion daily user activity events across 150,000+ websites and apps. Unlike transaction-specific identity data, Deduce captures a wide range of online activity (banking, gaming, communicating, browsing, shopping, etc.) for every identity. In many cases Deduce will have seen the customer within hours of their checkout and will know if the identity is legitimate or fraudulent. Stripped-down as digital goods purchases are—no phone number, no address, etc.—Deduce’s network still possesses enough real-time and historical data to determine if a user is the real deal.

To date, Deduce has seen close to 90% of customers within its network. So, if Deduce doesn’t recognize an identity, chances are that prospective digital goods customer is up to no good—or, at the very least, should be given a closer look. Multiple customers confirm that fraud is 10 times more likely if Deduce has not previously seen an identity on the network. On the other hand, Deduce’s real-time data ensures good customers are identified as such, and don’t fall victim to rigid fraud guidelines.

Real-time data, sourced from the largest identity graph in the US, is the only viable means of fighting digital goods fraud and keeping legitimate customers happy.

Contact us today and see why there’s no time like real-time.