Cybersecurity Makes or Breaks Today’s Fintech Valuations

If a fintech startup isn’t fortified, investors will be mortified

If a fintech startup isn’t fortified, investors will be mortified

Money 2020 in Las Vegas is officially in the books. Cybersecurity has been a hot topic at the conference over the past few years, and this year was no different.

One key takeaway from the event was that customers aren’t the only consideration for employing an optimal cybersecurity solution — today’s fintech companies, from payments and banking to lending and insurance, also have their valuations at stake.

To say fintech valuations are looking healthy would be an understatement. The recent IPOs of Toast and Remitly suggest that fintech and SaaS valuations may even be neck and neck (at least for the time being). However, with online fraud up 23 percent from April to July 2021, you can bet that investors are taking a long look at cybersecurity readiness before they break out their calculators (and checkbooks). They know that fintech and other types of enterprise companies are more susceptible to breaches in the modern cloud environment, and, due to the pandemic, the amount of online transactions has never been higher.

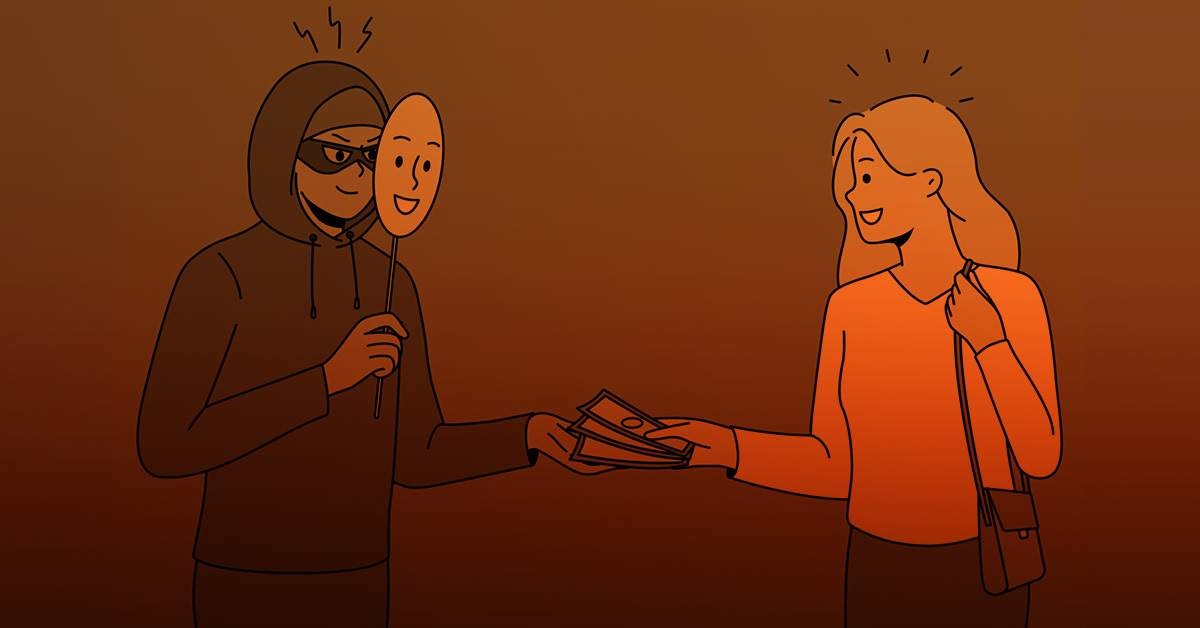

Quantitative data — revenue, profitability, growth, customer lifetime value, etc. — may be in short supply when investors dig into a nascent, or relatively nascent, fintech startup. In these cases, qualitative factors come into play, such as founder/team experience and market fit. Given the current online landscape wherein fraudsters are striking and varying their attacks faster than ever before, fraud prevention capability is also at the top of the list when investors are assessing valuations. They’re all about measuring risk, and what’s riskier than a company — particularly a financial enterprise — that can’t protect itself or its customers?

To maximize valuations in this climate, every fintech company must inherently be focused on cybersecurity, risk, and fraud at its core. Founders need to consider the relevance of their solution’s value proposition and the effectiveness of their company’s security measures. The fraud prevention technology of yore won’t cut it; investors want to see a data-driven, real-time solution that’s adaptive, preemptive, conducive to a positive customer experience, and fully compliant with data privacy regulations.

There’s another benefit to getting this right that goes beyond cybersecurity risk: implementing a powerful identity fraud prevention solution can provide a new account creation advantage. For example, one of Deduce’s customers, a personal finance and investing platform catering to young adults, wanted to provide the fast, seamless signup experience expected by their young customer base. However, the platform’s original new account authentication process took up to 48 hours. That’s a very long time for eager new investors to wait for approval — and plenty of time for them to find an alternative app.

In the early stages of implementing Deduce Identity Insights, this platform can now assess and approve qualified customers in near real-time, so they can start saving and investing right away. Deduce achieves this by scoring applications as part of the signup flow and alerting the platform’s manual review team to any that might be fraudulent, saving the team from having to manually review every new account.

An anti-fraud solution that neutralizes bad actors at the account creation stage and across all stages of the customer journey is an all-around great look. Great for customer experience and retention, great for brand reputation, and great for valuations.

Looking to swat away fraudsters before they attack? Try a free trial of Deduce today.