It’s Time to Give First-Checkout Fraud a Second Look

How do you verify a customer you’ve never seen before?

How do you verify a customer you’ve never seen before?

Spring is almost here. Sunny days will soon be upon us and it feels like the pandemic is finally tailing off. Seems the perfect time for fraudsters to rain on everyone’s parade and, boy, are they ever!

E-commerce fraud surpassed $41 billion in 2022. A recent bombshell report from the Federal Trade Commission found that fraudsters duped consumers out of $8.8 billion last year, a 44% increase from 2021. Additionally, the volume of phishing attacks grew by more than 175% over the past two years.

Fraud is surging across the board, but one type of fraud—to the chagrin of online merchants—is really riding the wave: first-checkout fraud.

Here is the skinny on what first-checkout fraud is, what makes it extra difficult to stop, and how businesses can solve for the unique problem it presents.

An overlooked threat

Deduce estimates that 71% of fraudulent transactions occur at first checkout or guest checkout. It’s not neuroscience. How are merchants supposed to approve or reject a transaction from a new “customer” with no payment history or outdated static PII data? It’s like playing in the Super Bowl and not having a scouting report on the other team’s players, zero intel on who’s who, their behaviors and tendencies. You can probably guess what team our money is on.

If a purchase involves a physical product, merchants can, of course, reject a first-checkout customer or refer the transaction to manual review. Not enough data? Why not err on the side of caution? But doing so doesn’t equal playing it safe. Sure, you might stop a potentially bogus transaction; however, this runs the risk of a false positive—rejecting a legitimate customer who isn’t likely to return.

Even if a merchant has access to PII data they can cross-reference, such as address and phone number, they’re unlikely to deploy 2FA for mobile shoppers as this added friction is a leading cause of cart abandonment. For similar reasons, thorough phone number verification, in particular, is unlikely if a user is transacting on a home wifi connection (static IP) or shopping on their laptop or tablet. In this scenario, fraudsters who possess a stolen phone number would get the green light as long as the bill-to and ship-to addresses match, though cunning fraudsters—if they aren’t buying digital goods—will opt for curbside pickup, have a product sent to their local FedEx, or contact the shipper and re-route to a different address.

In 2022, new account fraud, which also thrives on a fraudulent user’s anonymity, sucked 6% of revenue from almost 70% of businesses. It’s not far-fetched to believe first-checkout fraud is on a similar trajectory, especially with every kind of fraud having a field day (par for the course amid an economic downturn).

Synthetic shoppers

Another concern for e-tailers struggling with first-checkout fraud is the emergence of “synthetic shoppers.” Synthetic identity fraud, identified by the Federal Reserve as the fastest-growing form of financial fraud in the US, has been wreaking havoc in the online shopping world thanks to readily available PII data on the dark web.

Normally, a synthetic fraudster would stitch together a new “Frankenstein identity” using a combination of someone’s real name and phone number, among other PII, then establish a payment history to build credibility (they may even buy an aged email address). But a synthetic shopper merely needs stolen credit card credentials and a shopper profile they can easily auto-fill with a bot. They can start swindling e-commerce merchants in minutes.

At the core of all of this, though, is the identity intelligence issue. Trying to prevent online fraud with static data alone is problematic in its own right; first-checkout fraud is even more concerning because there’s zero historical purchase history data to go off of. What’s the fix?

The real-time remedy

To successfully combat first-checkout fraud, online merchants need real-time data. In fact, they need a stockpile of real-time identity intelligence only the upper crust of companies have at their disposal.

That sounds like a tall order, but Deduce can make up the height differential.

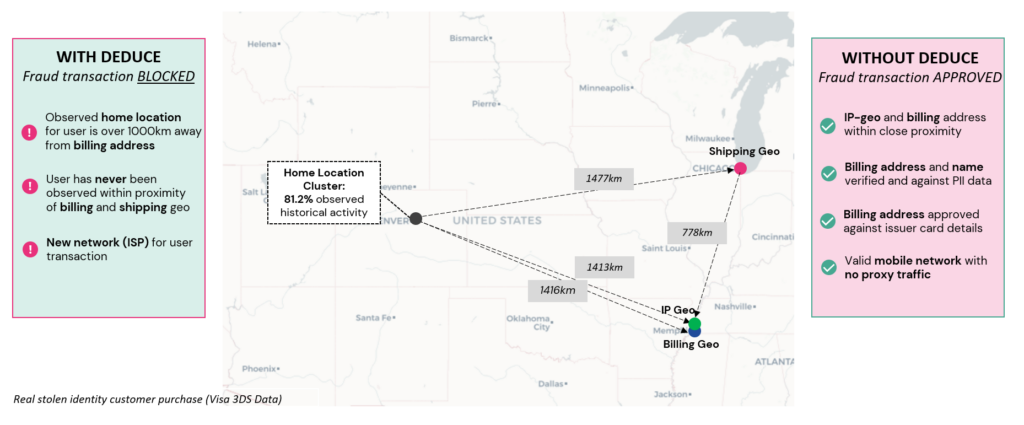

By tapping into our network of 680 million US privacy-compliant identity profiles and 1.5 billion daily authenticated user events across 150,000+ websites and apps, Deduce packs enough real-time insights to thwart (or approve) even the most nascent of shoppers. Typically, 89% of your new customers are already familiar to Deduce; 43% of these users have been seen by Deduce just hours before they make their first purchase.

Deduce leverages real-time data such as device type and ID, geospatial info, and more to ascertain if a first-time buyer is purchasing that flat screen TV or designer handbag legitimately. If a shopper is legitimate, our geospatial intelligence alone can mitigate common false positive drivers that plague first-checkout and returning shoppers alike. For instance, a customer with mismatched bill-to and ship-to addresses won’t be declined if Deduce sees prior history for the buying identity at the ship-to location.

In totality, Deduce’s real-time insights check for email familiarity and ensure a customer’s email and IP, geography and IP, and user history and address match—all at a massive scale. This arms merchants with high-confidence trust scores for first-time and guest checkout shoppers, enabling them to approve more transactions while reducing step-up and manual review costs.

Deduce, which integrates seamlessly with a merchant’s existing fraud stack, also determines the legitimacy of a first-checkout shopper without compromising the user experience. After all, a sluggish UX can turn off a potential customer if a wrongly flagged transaction doesn’t do the trick.

The uptick in online shopping has been a key revenue driver for merchants. The $48 billion in e-commerce fraud losses expected this year will have the opposite effect if mitigating first-checkout fraud isn’t prioritized.

Is your first-checkout engine light on? Contact us today and see how our real-time identity intelligence can accurately approve more legitimate transactions and reduce operational costs while rejecting fraudulent first-time purchases.