“Deduce is focused on transaction analysis speed and efficiency. Though they process high volumes of data, they do not retain PII within their systems so as to facilitate compliance with privacy regulations. Their alerting product can render decisions about impossible travel and quickly disseminate that status to downstream applications.

Moreover, Deduce has a unique Go-To-Market strategy, targeting eCommerce infrastructure providers rather than individual eCommerce vendors, which will likely facilitate adoption.”

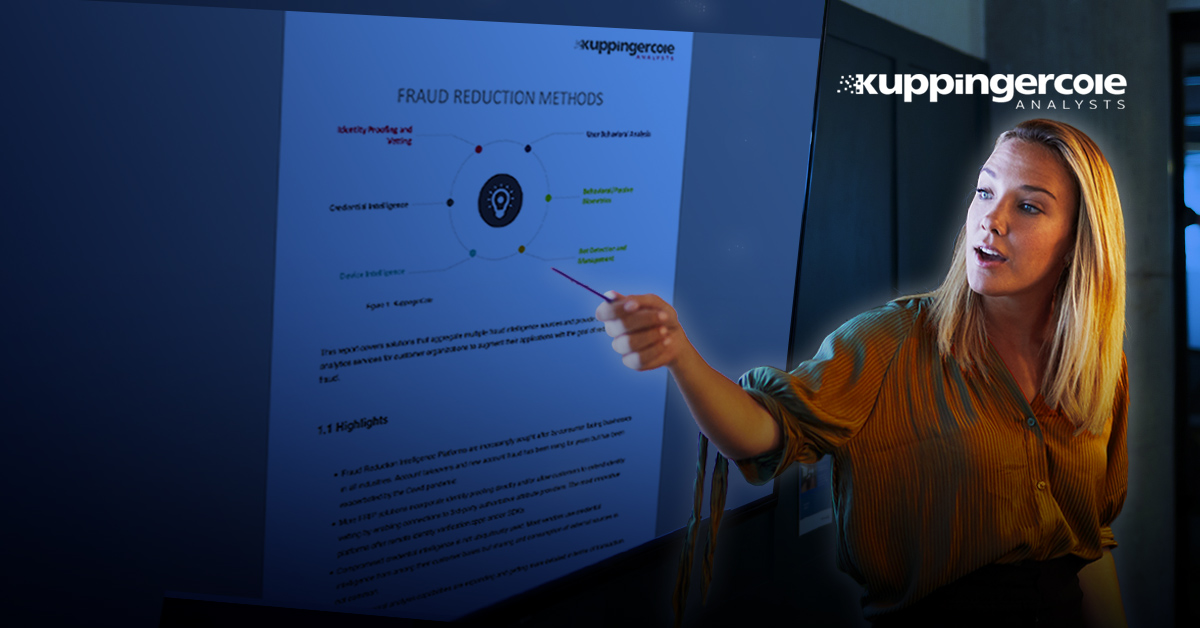

In this research report, you’ll learn:

- Why consumer-facing businesses implement fraud reduction intelligence platforms.

- How user behavioral analysis capabilities are expanding and getting more detailed in terms of transaction-level attributes.

- Why Deduce is a Vendor to Watch in this space.

See how the award-winning Deduce Identity Insights solution uses Real-Time Behavioral Intelligence at Scale to prevent fraud and protect the Trusted User Experience.

About Deduce

Deduce detects stolen and synthetic AI-driven identities that fool legacy identity-fraud security solutions and damage trust. Deduce unmasks these identities using patented technology and the largest purpose-built, activity-backed identity graph, which sees 185M+ identities more than three times every week, generating 1.5B+ authenticated online events per day across 150,000+ websites and apps. Deduce Identity Graph data drives real-time multicontextual digital forensics to protect new account opening workflows, expose “sleeper” stolen and synthetic identities that are already in customer databases, reduce friction and false positives in onboarding, reduce onboarding operational costs, and improve customer acquisition KPIs.

Deduce awards include Tech of the Future – Fighting Fraud at the 2024 Banking Tech Awards USA, the #1 Security spot in Fast Company’s World’s 50 Most Innovative Companies 2022, and the 2022 CISO Choice Award for Fraud Prevention. Learn more about the AI-driven identity fraud threat and Deduce’s solution at deduce.com.