AI-Driven Stolen and Synthetic Identity Fraud Are Destroying Trust

With AI Supercharging Identity Fraud Now, Who Can You Trust?

Stolen and synthetic identities leverage AI to get past legacy fraud prevention and identity verification solutions, starting a vicious cycle that leads to fraud, more friction for good customers, and more false declines.

Deduce is the only solution provider with the identity graph and resources to identify these identities and interrupt the cycle.

Stolen and Synthetic Identity Fraud:

Growing Fast, Hard to Prevent

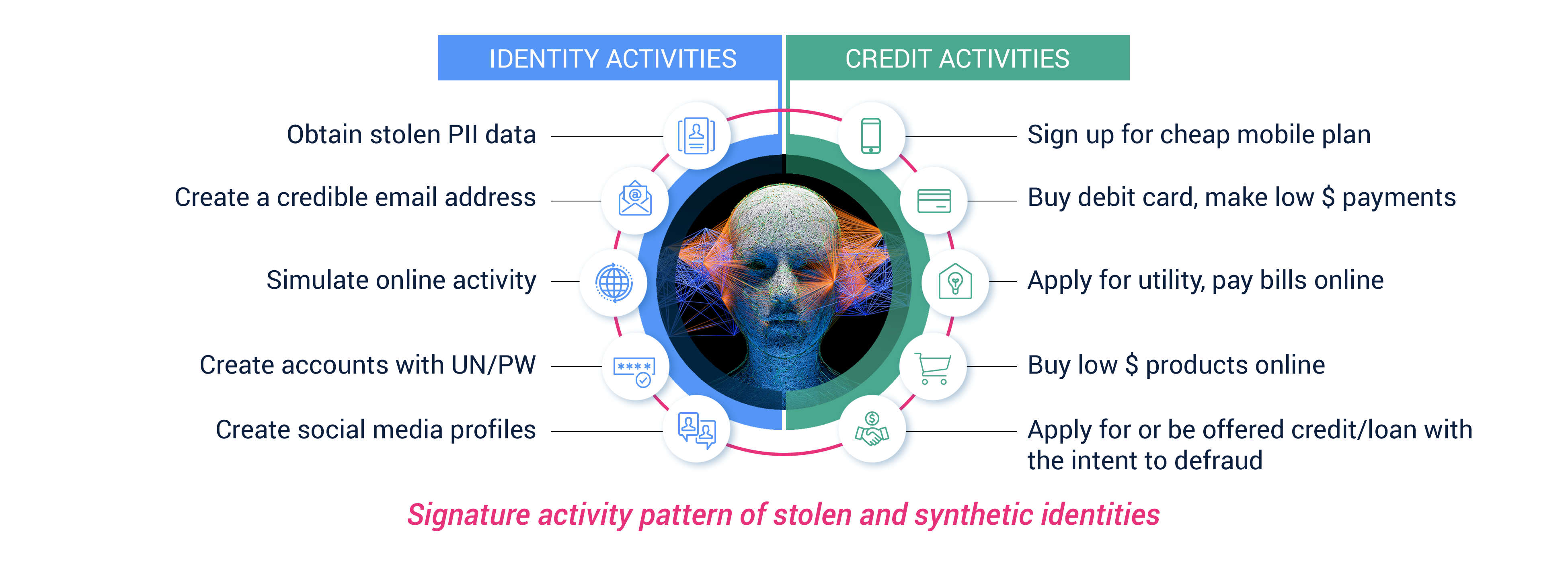

Fake identities made with AI technology can include realistic-looking documents, biometrics, activity and credit histories, and other characteristics that seem real to legacy identity fraud solutions and fraud prevention analysts.

“At financial institutions, it’s estimated that 95% of synthetic identities are not detected during the onboarding process.” Thomson Reuters, 2023

This kind of identity fraud is a long game played at scale. When batches of these identities get approved as bank and fintech customers, they wait. AI keeps their activities up to date, so they continue to seem real.

When the bank or fintech company platform offers these “customers” credit, the criminals behind these identities take it and disappear. That leaves lenders with fraud-related losses—over $15,000 per event according to the FTC—and urgent questions about how many more fake customers are still lurking in their databases.

In response, many organizations recalibrate the risk thresholds in their legacy identity and document verification solutions. This creates more friction, more false declines, and a negative overall impact on customer acquisition KPIs—all without solving the problem of stolen and synthetic identity fraud.

Brands Protected by Deduce

Deduce Detects Stolen and Synthetic Identities in Real Time

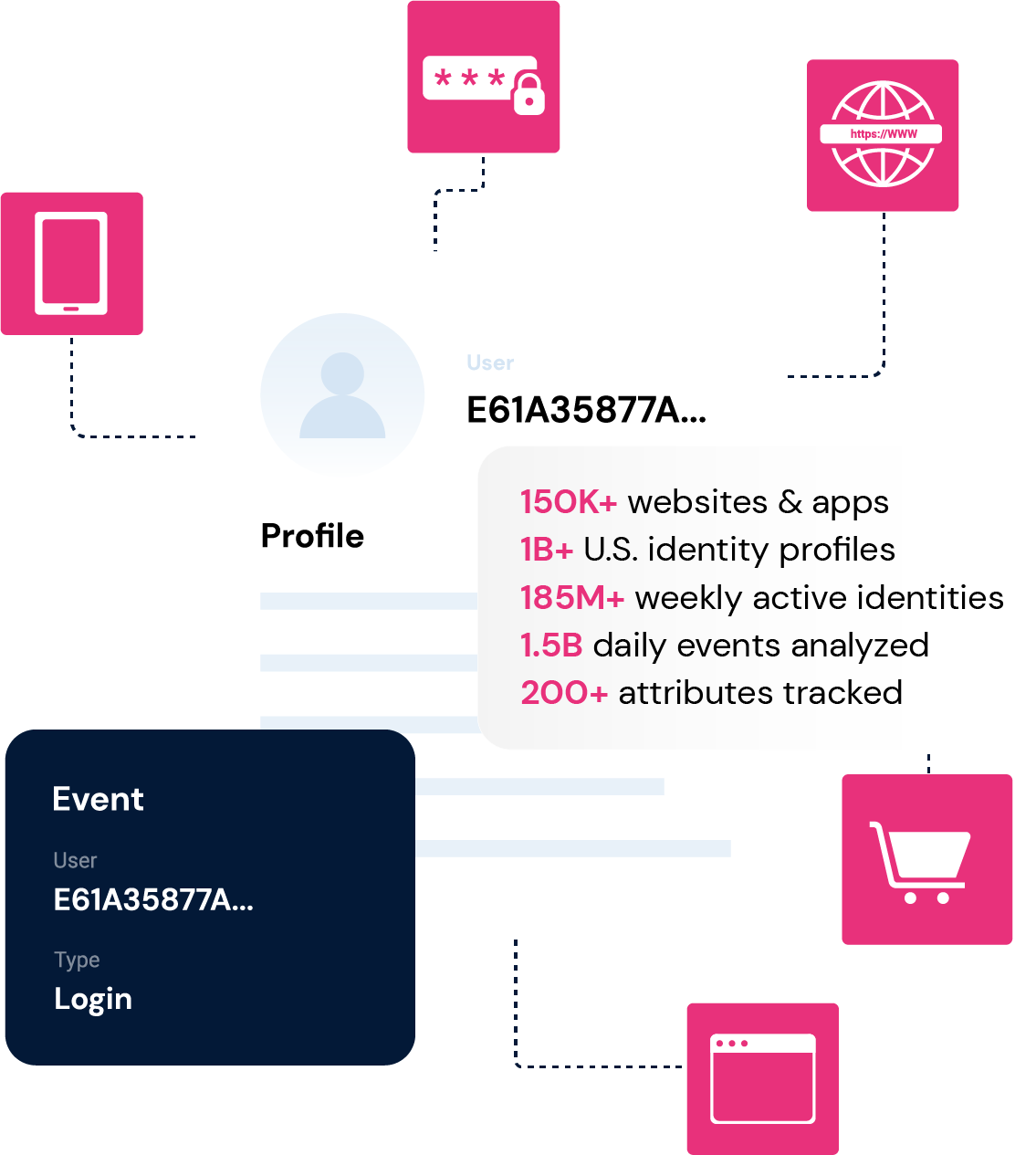

Deduce offers the only solution for keeping stolen and synthetic identities from signing up as your customers, and for flagging the ones already embedded among your customers.

With Deduce’s patented technology combined with the Deduce Identity Graph, your organization can:

- Prevent GenAI-created identities from creating new customer accounts.

- Identify and flag GenAI-created identities that have already become your customers.

- Reduce your medium- to long-term exposure to stolen and synthetic identity fraud.

- Maintain trust in the authenticity of your verified customers.

- Reduce friction and false declines in the onboarding process.

Learn more about how Deduce uses the largest activity-backed U.S. fraud and risk identity graph to conduct multicontextual, real-time data forensics at scale.

The Most Awarded Company in Identity Security

Featured Resources

Prevent AI Generated Identity Fraud

Stolen and Synthetic Identity Fraud Prevention Has a Trust Problem

Run Your Deduce Proof of Value Today